Are you interested in a career that offers great financial rewards and opportunities for growth? Financial analysts play a crucial role in helping businesses make informed decisions by analyzing financial data. In this blog post, we will explore the importance of financial analysts in the business world, their roles and responsibilities, the various industries they can work in, and the necessary skills and qualifications to excel in this field. We will also delve into the factors that can influence financial analyst salaries and the average salary range you can expect. Additionally, we’ll discuss the high-paying industries for financial analysts and career advancement opportunities available in this field. Finally, we’ll share some valuable tips to help you maximize your financial analyst salary. So, if you’re considering a career as a financial analyst or are already in the field, keep reading for valuable insights on how you can analyze financial data with a generous salary in mind.

Table of Contents

Importance of Financial Analysts in Business

Financial analysts play a crucial role in the success and growth of businesses. They are responsible for analyzing financial data, assessing market trends, and providing valuable insights that help companies make informed decisions.

One of the key importance of financial analysts is their ability to help businesses optimize their financial performance. By carefully examining financial statements, cash flow, and profitability, analysts can identify areas for improvement and develop strategies to maximize revenue and minimize costs.

Furthermore, financial analysts also play a vital role in forecasting future financial trends and risks. Their expertise allows businesses to anticipate and prepare for potential challenges, as well as capitalize on emerging opportunities in the market.

In addition, the insights provided by financial analysts are essential for attracting investors and securing funding for business expansion and development. Their detailed financial reports and forecasts give stakeholders the confidence and assurance they need to invest in the company.

What Does a Financial Analyst Do?

Financial analysts play a crucial role in the success of a business by helping companies make informed financial decisions. They are responsible for analyzing financial data, creating financial models, and providing insights to support strategic business planning.

One of the main tasks of a financial analyst is to assess the financial performance of a company by analyzing its financial statements, cash flows, and market trends. This involves identifying potential risks and opportunities for the business and providing recommendations to improve financial performance.

Financial analysts also play a key role in forecasting and budgeting, helping businesses plan their financial future and make well-informed decisions about investments, budget allocations, and cost-saving initiatives.

In addition, financial analysts often conduct industry and market research to understand the competitive landscape and identify potential investment opportunities. This requires staying up-to-date with market trends, economic indicators, and industry developments to provide valuable insights to the company.

Exploring the Various Industries for Financial Analysts

Financial analysts play a crucial role in the business world, providing valuable insights and recommendations to help companies make informed financial decisions. These professionals are in demand across a wide range of industries, each offering unique opportunities and challenges for financial analysts.

One industry that often employs financial analysts is the banking and finance sector. Financial analysts in this field typically work for banks, investment firms, and financial services companies, helping to assess the performance of investments, evaluate risk, and make recommendations on potential investment opportunities. They may also be involved in assessing the creditworthiness of individuals and businesses seeking loans or lines of credit.

Another industry that relies heavily on the expertise of financial analysts is the healthcare sector. These professionals in this field may work for hospitals, insurance companies, or pharmaceutical firms, providing financial analysis to help improve efficiency and reduce costs, as well as evaluate the financial impact of new healthcare policies and regulations.

Technology is also a booming industry for financial analysts, with many working for large tech companies or startups. In this role, financial analysts may be responsible for evaluating the financial impact of new products or services, conducting market research, and helping to make strategic financial decisions to drive growth and profitability.

Skills and Qualifications Required for Financial Analysts

Financial analysts play a crucial role in helping businesses make sound financial decisions. In order to excel in this profession, individuals need to possess a strong analytical mindset. This includes the ability to interpret and evaluate complex financial data to provide insights and recommendations to stakeholders. Additionally, critical thinking skills are essential for identifying trends, patterns, and potential risks within financial reports.

Furthermore, a solid understanding of finance and accounting principles is necessary for financial analysts. This entails knowledge of financial statements, budgeting, forecasting, and risk assessment. Proficiency in financial modeling and data analysis software is also vital for processing and interpreting financial information effectively.

Strong communication and presentation skills are another key requirement for financial analysts. They must be able to convey their findings and recommendations clearly and effectively to non-financial stakeholders. As the role often involves collaborating with various teams and departments, interpersonal skills and the ability to work in a team are crucial for success in this field.

Lastly, education and certifications play a significant role in qualifying for a career as a financial analyst. A bachelor’s degree in finance, accounting, economics, or a related field is typically required, with many employers seeking candidates with a master’s degree or professional certifications such as the Chartered Financial Analyst (CFA) designation.

Understanding the Role of Analyzing Financial Data

Financial data analysis is a crucial aspect of any business, as it involves examining financial information to make strategic decisions. It involves interpreting and evaluating financial statements, including balance sheets, income statements, and cash flow statements. Financial analysts use various tools and techniques to analyze this data and provide insights to the management team, helping them make informed decisions to drive the company’s growth and profitability.

One of the key roles of analyzing financial data is to identify trends and patterns that can impact the company’s performance. By analyzing historical data, financial analysts can forecast future trends and provide recommendations to mitigate potential risks or capitalize on opportunities. They play a critical role in helping the company allocate resources efficiently, manage costs effectively, and maximize profitability.

Financial data analysis also involves conducting industry and market research to understand the competitive landscape and identify potential areas for growth. Financial analysts need to keep abreast of market trends, changes in regulations, and emerging technologies that may impact the company’s financial performance.

Moreover, analyzing financial data also involves communicating the findings to key stakeholders, such as senior management, investors, and regulatory authorities. Financial analysts must possess strong communication skills to clearly articulate their insights and recommendations, influencing decision-making processes and driving the company towards its strategic goals.

Factors that Influence Financial Analyst Salaries

Financial analysts play a crucial role in helping businesses make informed decisions about their finances. They are responsible for analyzing financial data, preparing reports, and providing recommendations to management. As a result, the skills and qualifications possessed by financial analysts greatly influence their salaries.

One of the key factors that influence financial analyst salaries is their level of experience. Generally, entry-level analysts earn lower salaries compared to those with several years of experience in the field.

Another factor that directly impacts salaries is the location of the job. Financial analysts working in major financial hubs such as New York City or London tend to earn higher salaries compared to those working in smaller cities or regions with lower living costs.

Furthermore, the type of industry in which a financial analyst works can also affect their salary. For instance, those working in the banking or investment sector may earn higher salaries compared to those in the non-profit or government sectors.

Average Salary Range for Financial Analysts

Financial analysts play a crucial role in helping businesses make informed financial decisions. They are responsible for analyzing financial data, studying economic trends, and assessing a company’s financial performance. With such a vital role, it’s essential to understand the average salary range for financial analysts to attract and retain top talent in this field.

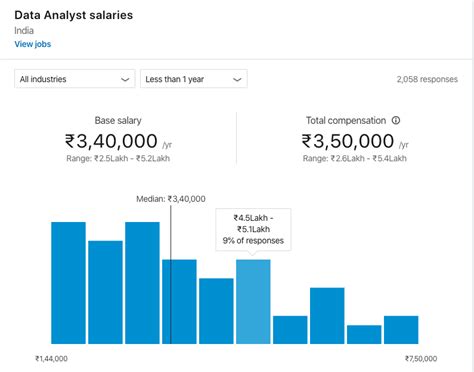

According to the Bureau of Labor Statistics, the median annual wage for financial analysts was $83,660 in May 2020. The lowest 10 percent earned less than $50,430, and the highest 10 percent earned more than $157,150. It is important to note that salary ranges can vary based on factors such as experience, education, industry, and geographical location.

Financial analysts working in the securities, commodity contracts, and other financial investments and related activities industry earned a median annual wage of $100,460, while those employed in the management of companies and enterprises industry earned $88,620. Geographic location also plays a significant role in salary discrepancies, with financial analysts in New York, California, and Connecticut typically earning higher wages compared to those in other states.

It’s important for aspiring financial analysts to consider these salary ranges and factors when pursuing a career in this field. Employers should also be mindful of these trends to offer competitive compensation packages and attract top talent in the industry.

High-Paying Industries for Financial Analysts

Financial analysts play a crucial role in helping businesses and individuals make sound investment decisions. They are responsible for analyzing financial data, keeping track of market trends, and providing insights that can lead to profitable outcomes. As the demand for skilled financial analysts continues to grow, so does the potential for high-paying opportunities within certain industries.

One industry that often offers lucrative opportunities for financial analysts is the investment banking sector. Investment banks frequently seek the expertise of financial analysts to help evaluate and advise on potential investment opportunities, mergers, and acquisitions. The high-stakes nature of this industry can result in substantial financial rewards for those with the right skill set and qualifications.

Another industry that offers high-paying roles for financial analysts is the technology sector. As technology companies continue to thrive and innovate, there is a growing need for professionals who can navigate complex financial landscapes and provide strategic guidance. Financial analysts in this industry can expect competitive salaries and the potential for career growth as they contribute to the success of cutting-edge companies.

Additionally, the healthcare and pharmaceutical industries are known for offering high-paying positions to financial analysts. These sectors require individuals who can accurately assess financial risks, manage budgets, and identify opportunities for growth. As healthcare and pharmaceutical companies expand and diversify, the demand for skilled financial analysts remains strong, with an opportunity for substantial compensation.

Career Advancement Opportunities for Financial Analysts

As a financial analyst, there are several career advancement opportunities available to help you progress in your profession. One such opportunity is to pursue advanced certifications, such as the Chartered Financial Analyst (CFA) designation, which can demonstrate your commitment to the field and enhance your credibility as an expert in financial analysis.

Another way to advance your career as a financial analyst is to seek opportunities for leadership roles within your organization. By taking on managerial responsibilities and leading teams, you can demonstrate your ability to handle greater levels of responsibility and contribute to the strategic direction of the company.

Furthermore, pursuing additional education, such as obtaining a master’s degree in finance or pursuing an MBA, can provide you with the knowledge and skills needed to advance your career as a financial analyst.

Lastly, networking within the industry can also open up doors for career advancement. By connecting with other professionals in the field, attending industry events, and being active in professional organizations, you can increase your visibility and access opportunities for advancement.

Tips to Maximize Your Financial Analyst Salary

As a financial analyst, there are several strategies you can employ to maximize your salary potential and advance in your career. First and foremost, it’s important to continuously develop and improve your skills and qualifications in order to stand out in a competitive job market. This can involve obtaining advanced degrees such as an MBA or earning professional certifications such as the Chartered Financial Analyst (CFA) designation.

Another important tip for maximizing your financial analyst salary is to gain experience in high-paying industries. By specializing in areas such as investment banking, hedge funds, or private equity, you can increase your earning potential. Additionally, seeking out opportunities for career advancement within your current company or by transitioning to a new employer can lead to higher salaries and greater professional growth.

Networking and building strong relationships within the finance industry can also be beneficial in maximizing your financial analyst salary. By connecting with professionals in your field, attending industry events, and staying up to date on industry trends, you can position yourself for higher paying opportunities and career advancement.

Finally, it’s important to be proactive in negotiating your salary and benefits. By conducting research on average salaries for financial analysts in your region and leveraging your experience and qualifications, you can make a strong case for a higher salary. Additionally, considering alternative forms of compensation such as performance bonuses, stock options, and additional benefits can further enhance your overall earning potential as a financial analyst.